Trade in Burgundy investment wines has exceeded total 2020 levels at the end of Q3 2021. The removal of tariffs that imposed an additional 25% margin for US buyers in March this year has further energised a market seeing strong growth since the start of the pandemic. Investment wines from the region are seeing rising prices in 2021 and are important additions to your wine portfolio.

Burgundy investment wine performance headlines

- Burgundy 150 index up 12.5%

- DRC wine indices outperform Liv-ex market trend

- DRC still the most traded Burgundy estate by value

- DRC Grand Echezaux index up 23.3% = top performing DRC wine index in 1 year

- DRC Prices continue to rise driven by rarity

- 2017 Burgundy vintage a target for investors

- DRC Romanée Conti led trade by value at £191,000 (12 x 75cl BMP)

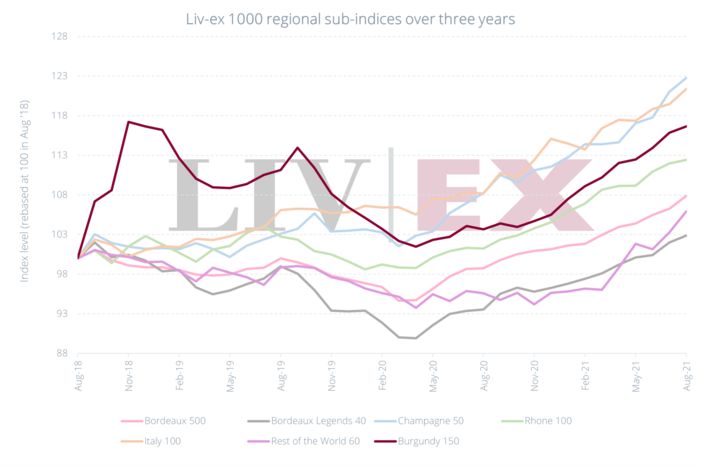

Year-to-date trade in Burgundy was 10% more than the entire 12 months of 2020 at the end of Q3 2021 More than 3,200 transactions in the region’s wines took place in the 9 months to 30th September in a broadening market in Burgundy. The Liv-ex Burgundy 150 is now close to its November 2018 peak.

Prices in the iconic brands of the region, and in particular Domaine de la Romanée Conti (DRC), hit record levels in November 2018. Investors seeking value in the region sought out less well-known brands, with little or no presence in the secondary market. As a result, DRC and a few other key brands, suffered a temporary price slip during 2019.

The significant broadening market in Burgundy investment wines has seen DRC’s share of trade on Liv-ex fall from 54% of the Burgundy market ten years ago in 2011 to its now record low of 15%. This doesn’t suggest any lack of interest or demand for the Burgundy icon, rather that the secondary market in Burgundy in 2021 is much larger and more varied.

Most traded DRC Wines in 2021

| DRC WINE | TOP TRADED VINTAGES IN 2021 |

| DRC Romanée Conti | 2006, 2009, 2017 |

| DRC La Tâche | 2017, 1995, 2009 |

| DRC Romanée –Saint-Vivant | 2013,2017, 2009 |

| DRC Richebourg | 2017, 2009, 1993 |

| DRC Grands Echézaux | 1995, 2017, 2009 |

| DRC Echézaux | 2011, 2017, 2009 |

Source: Liv-ex.com

Very low production levels and increasing rarity are strong influencing factors on the very high prices DRC wines can command. DRC Romanée Conti 2006 led trade by value on Liv-ex in the last year at £191,000 (12 x 75cl BMP), but individual highlight sales have achieved values of more than £400,000 for single bottles of very rare vintages.

The 2021 harvest predictions may also influence back vintage values. With substantially lower crop volumes in key wine growing areas across Europe a consequence of devastating frosts in Spring 2021, reduction in supply is expected and price predictions have a rising trajectory.

DRC in particular is one of the key investment wine that has the potential to deliver significant long-term, ‘nest-egg’ value primarily due to its extreme rarity. For more information on investing in Burgundy and the latest opportunities available speak to a member of our team on 0203 384 2262.