Liv-ex has published a trade report analysing the trends in its current top performing region as the market focus turns to the Burgundy 2017 vintage en primeur campaign. The report states that the Liv-ex Burgundy 150 has delivered a compound annual growth rate of 12.7% since the regional index was established in December 2003. It has truly been a “strong and stable” performer resisting the volatility in financial markets and delivered a more robust price performance than the Bordeaux benchmarks over the last few years.

Since 2010 the Burgundy 150 has risen 168.8% and market share on Liv-ex has moved from 1% to 14.5% (by value). The index tracks the price movements of the most actively traded Grand Crus and its record breaking performance last year not only established the Burgundy 150 as the top performing component of the broader Liv-ex 1000 in 2018 but saw it beat the overall Liv-ex 1000 trend.

The gap between the price performance of Burgundy wines and those from all of the other key fine wine regions continues to grow as the index rose 34.9% in 2018 in comparison to more modest growth elsewhere. Record auction sales highlighting the performance of the top brands of the region helped sustain profile and demand. Less susceptibility to currency volatility has also been a key factor in Burgundian wine performance.

From a global perspective, the Burgundy 150’s growth of 35% has out-stripped Asian, European and US equities, and Gold’s 5% gain over the last 12 months was ranked second to Burgundy.

The iconic status of DRC wines, similar to the rare Cult Californian wines such as Screaming Eagle, would suggest that we should compare the price performance of these wines with luxury brands groups such as Louis Vuitton Moet Hennessy (LVMH). The Liv-ex report looks at the performance of the DRC index and contrasts it with the share price performance of LVMH, Hermes and Apple. A key influence on these brands is the demand from Asian consumers and in the second half of 2018 the decline in the Chinese market was apparent in financial markets. Apple’s share price led the way dipping by 5%, Hermes felt it more keenly with a 17% fall, but in comparison the DRC Index rose by 26.3% over the year. Fine wine’s tangible asset status and resistance to the downward pressures of a challenging economic environment are seen as key reasons for its successful performance in comparison to shares.

LVMH’s share price is viewed as an important indicator of the general demand for luxury goods by Chinese consumers in particular and the DRC index has shown a marked correlation to it over the last few years. Some commentators question what impact a Chinese economic slowdown may have on Burgundy especially when there is considerably better value to be had elsewhere. Is it possible we may see a similar scenario to that suffered by the First Growths in 2011 to 2014? We point to the global scarcity of top Burgundies as a key mitigating factor.

In terms of value, when you compare the region’s Grand Crus to the Bordeaux First Growths the prices paid for the former are considerably higher, primarily due to the variance in supply. Liv-ex estimates the annual production of the DRC vineyards between 7,000 to 8,000 cases per annum compared to an average 70,000 cases for each of the First Growth Grands Vins. DRC supply appears to be ten times lower and the current average prices achieved can be ten times higher!

In 2002, DRC wines accounted for 96% of the value in Burgundy sold on Liv-ex, and as the region’s market share has grown this has reduced to 30% at the end of 2018. The market focus has broadened to include other brands and Leroy, Armand Rousseau and Ponsot have been key drivers in Burgundy’s growth. This has not deflected from the continued rise in the prices achieved by DRC wines. The DRC index rose 28.6% in 2018 and over the last five years it has measured a 120% increase, exceeding the Burgundy 150’s growth of 104% over the same period.

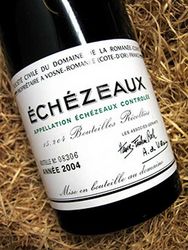

We have commented previously on the record-breaking auction sales last year of two bottles (75cl) of Domaine de la Romanée-Conti, Romanée-Conti 1945 (referred to as a ‘Unicorn’ vintage) at the astronomical prices of £424K and £377K. This is far from the average case price of more widely available vintages, but of the DRC labels Echezeaux has performed best recently with a growth of 246% in the five-year period from the end of 2013. This impressive performance could be put down to a lower entry point than Domaine de la Romanée-Conti, Romanée-Conti and one has to ask the question how much more room for growth is there on certain vintages from the Burgundy super-star.

Top 10 most Powerful Burgundy Brands in 2018

| No. | Brand | Average trade price | Average price growth | Liv-ex Power 100 2018 Ranking |

| 1 | Leroy | £1,806 | 58.17% | 1 |

| 2 | DRC | £30,472 | 33.47% | 3 |

| 3 | Armand Rousseau | £6,420 | 42.66% | 7 |

| 4 | Coche Dury | £5,384 | 23.61% | 9 |

| 5 | George Roumier | £9,066 | 55.62% | 11 |

| 6 | Domaine Leflaive | £2,025 | 14.91% | 13 |

| 7 | Francois Lamarche | £3,512 | 21.03% | 23 |

| 8 | Comte Vogue | £4,455 | 16.17% | 24 |

| 9 | Dujac | £2,654 | 51.11% | 35 |

| 10 | Ducru Beaucaillou | £1,281 | 5.49% | 36 |

Source: Liv-ex Report, Burgundy In the Spotlight, January 2019

Leroy took the market by surprise with its first place position in Liv-ex’s Power 100 ranking of the most important brands in the fine wine market in 2018. The average price growth of 58.17% of Leroy’s wines was very much driven by tight supply and overall market forces applied to Burgundy.

The market is now getting its first taste of the 2017 vintage, the largest since 2009 and of very good quality, this crop could test the region’s current pricing levels. There has been a suggestion that the more plentiful 2017 release, following the much lower supply of the previous three vintages, may also allow the producers to explore new markets and replenish their own cellar supplies for later releases at higher prices. But supply is all relative in the global market and new owners of the most sought after 2017 Burgundy wines could become price-setters almost overnight.

For more information on the current best Burgundy offers in the market contact us now on 0203 384 2262.