Probably the biggest currency news event this year has taken place over the last few days: the Peoples Bank of China has devalued the Yuan by around 4% in two days and around 10% since April, albeit from all-time highs at that time. It’s important to remember that the Yuan is not really a free floating currency, it trades within daily boundaries set by China; what’s happening right now is that these boundaries are being loosened and the market is being allowed to play a greater role, resulting in a falling Yuan.

2015 has been a fascinating year so far for followers of currency dynamics. Not only have we seen the fall in the Yuan (the biggest devaluation in 20 years), but also big falls in the Euro, (coming close to the lowest rates in a decade), and we’ve had the near collapse of the Russian Rouble, followed by a dramatic recovery and then another massive (if slower) sell off in the last few months.

Why this is happening, and why this is happening now, is a topic for much more detailed discussion, and is all very geopolitically interesting, but what can we as investors learn from these movements, and how can we profit from them?

The most dramatic example is in Russia which shows clearly how significant the impact of currency fluctuation can be. The chart below shows the amount of GBP one Rouble would buy over the course of the last year, with the smaller graph underneath showing movements over the last decade, illustrating the significance of this fall:

Source: www.xe.com

Vin-X have long contended that wine offers an exceptional currency hedge, the movements in three of the worlds major currencies show how effective this can be for capital held in wine.

Currency markets this year have provided us with a very real lesson in why it pays to hold some of your investments in freely convertible assets like gold, oil and wine, to diversify on traditional investment classes such as equities and property. Vin-X have a number of Russian clients most of whom had to change Roubles for Sterling originally to buy their wine and have as a result gained significantly if we measure their investment in Roubles.

Imagine you’d purchased a case of Mouton Rothschild 2000 for £11,000 in August 2011: it would be showing only a modest gain in Sterling of around 5%. However in Roubles it would have cost ₽497,970 and would now be worth ₽1,163,915, giving 133% uplift. Even wines that have not fared so well as Mouton 2000 have performed well when denominated in roubles: Mouton 2009 would have cost around ₽310,000 at release, and despite having fallen significantly in Sterling prices it would now be worth around ₽455,000, a gain of 46% to our theoretical Russian owner. This assumes of course that the investor converts the cash back into Roubles upon sale!

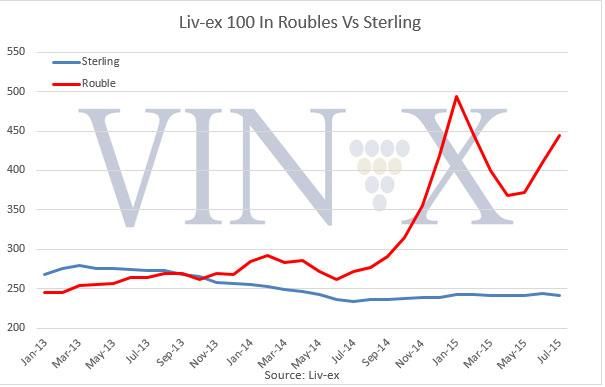

Another way for us to see this is to compare the Liv-ex 100 index valued in Sterling and Roubles as seen in the chart below. Whilst 2015 has seen modest growth if denominated in Sterling, it has been a year of pretty stunning appreciation for Russian wine investors.

Chart: Liv-Ex 100 denominated in Roubles and Sterling for the last two and half years, rebased in December 2003.

There are two major ways to take advantage of currency fluctuations like this, the first is arbitrage; the practice of buying something in a location or geographic market where it’s price is low and selling where the value is high. The physical nature of wine and the 30 day terms that operate with almost ALL suppliers complicate this significantly and make it impractical for even market professionals like Vin-X let alone private investors. Besides our view is that fine wine as a very stable asset class without the volatility of financial markets, is a medium to long-term investment.

The second way we can take advantage of currency dynamics is by targeting suppliers who trade in ‘stressed’ currencies. Therefore Vin-X have been buying much more wine from Europe this year than previously and right now are buying wine from Chinese and Russian owners (although our clients should rest assured we certainly won’t be buying wines that have left the safe confines of Bordeaux or UK storage), at lower Sterling prices in the knowledge that when they convert the Sterling back to Yuan their losses will be minimised due to the falls in local currency.

For more information on acquiring wine to protect wealth contact the Vin-X team now on 0203 384 2262