Investors are seeking havens for savings as inflation recorded a 30-year high of 5.4% in the 12 months to December 2021. With forecasts suggesting the CPI benchmark could rise to 7% by April savings are at risk. Wine investments recorded average growth of 23% last year and offer investors a tax-efficient option to protect capital.

The 5.4% CPI growth in 2021 exceeded the economic forecasts of 5.2% and keeps inflation on track for an estimated 7% level in April this year. Whilst some of the factors influencing inflation can be resolved in the short to medium term, i.e. supply chains and even energy, expected to fuel bill increases of around 50% after the cap is removed, forecasters see it remaining above 4% throughout 2022.

The Bank of England is set to meet on February 3rd to decide on a potential further interest rate rise which is looking extremely likely. Some commentators foresee a lift to 1.25% this year in phased increases. A difficult decision to impose further challenges on an already beleaguered consumer. Wage costs have been rising due to a tight labour market but the annual average wage growth of 3.8% recorded in December is not keeping pace with inflation and the cost of living is eroding cash.

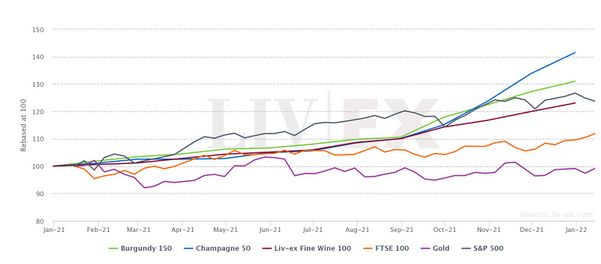

How did fine wine perform compared to gold and equities in 2021?

What does this mean for investors? Further economic uncertainty and likely volatility on financial markets and the real need to look at assets that can hedge inflation and hold or grow value. Looking at the performance of alternative investments like property, wine and even cryptocurrency, fine wine delivered strong growth and stability throughout 2021. Fine wine offers tax efficient returns, an affordable entry point, diversification and liquidity compared to these assets.

For more information on fine wine investment performance and our recommendations for 2022, contact our team on 0203 384 2262.