Is COVID-19 driving investors to fine wine? Liv-ex has reported recently that buyers taking advantage of ‘soft Sterling’ priced fine wine pushed overall trade value on the exchange up 50% on the previous week ending the 5th March. This period obviously coinciding with growing numbers of Coronavirus cases in the UK, significantly increased press intensity and extreme volatility in financial markets. We have to ask is this a precursor of things to come as newsfeed is focusing strongly on consumer protection both in terms of health and the economy.

What wines are they buying into? Italian wines are still a key focus and its regional share of trade continues to grow on Liv-ex.

Regional share of trade on Liv-ex by value (28.02.20 – 05.03.20)

| Region | Share of total trade | Previous week’s share | February 2020 share |

| Bordeaux | 47.6% | 49.6% | 45.3% |

| Italy | 17.1% | 11.8% | 13.0% |

| Burgundy | 15.0% | 14.0% | 20.3% |

| USA | 8.5% | 1.9% | 4.6% |

| Champagne | 6.4% | 13.8% | 8.8% |

| Others | 3.3% | 5.1% | 5.2% |

| Rhone | 2.1% | 3.8% | 2.8% |

Source: Liv-ex.com March 2020

Since these figures were published we have had the new Chancellor’s budget published, the focus of that being to provide whatever resources are needed to deal with the Cornoavirus crisis and to ‘vaccinate the economy’ – but again this is wholly unpredictable at this stage. Simultaneously, the Bank of England also took the unexpected measure of reducing interest rates by 0.5% demonstrating their analysts’ view on the potential impact on the economy and consumer behaviour.

Today the FTSE 100 has experienced its largest one day fall of 9% and US financial markets have been suspended again to limit falls as they responded negatively to Trumps’ latest Coronavirus sanctions with US equities now having been impacted to such an extent that all the gains during Trump’s presidency to date have been wiped out. Back across the pond Ireland has also announced the closure of all schools and RBS and NatWest Banks have announced mortgage measures to help borrowers.

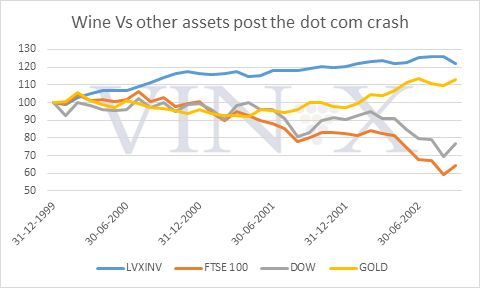

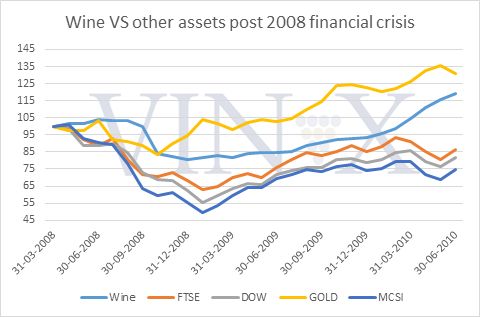

We have experienced financial shocks before and it’s useful to remind ourselves how fine wine behaved in the most recent crashes. Liv-ex data is available to compare performance against equities and gold during the Dot.com crash and the 2008 banking crisis.

Liv-ex’s February 2020 data published in their latest March Report to trade members this week shows a diversion from the general trend since early 2019 with fine wine seeing an upturn in performance with the Liv-ex 100 reporting 0.2% growth against falling equities, FTSE down -9.7% and S&P500 falling -8.4% in February 2020 as published in our earlier blog – Does Fine Wine Offer a Safe Haven from COVID-19?

Fine wine prices were depressed in 2019 due to Brexit uncertainty and US Tariffs – there is an opportunity now to acquire these wines at prices positioned well for growth, especially if the worst happens and commentators forecasts about recession become real. The financial data this week is certainly extremely worrying and investors must be considering where to safely invest now. A reminder again that fine wine tends to be relatively resistant to the downward forces of recession and as a tangible asset can be used to protect capital and diversify risk.

Tax is important, and as we approach the end of the tax year it is worth remembering that any gains on fine wine sales should be exempt from Capital Gains Tax – we always recommend that you discuss your personal circumstances with your IFA or professional tax advisor.

For more information contact us now on 0203 384 2262.