HM The Queen celebrated her 94th birthday in a rarely muted way this month with the traditional gun salutes silenced for only the second time during her reign. Covid-19 hasn’t however suppressed the fine wine investment market or our wish to mark a special moment where we can. With nine Champagne Houses currently holding royal warrants, we would hope Her Majesty raised a toast on the big day.

The House of Windsor’s fine wine cellar enjoys custodians such as Master of Wine and international critic Jancis Robinson and over the period of the Queen’s reign eight royal warrants awarded to Champagne producers have been sustained by Her Majesty. Bollinger is the oldest of the great Champagne houses to be a royal warrant holder, first granted in 1884. Keeping excellent company are Krug, Louis Roederer, Moet & Chandon, Pol Roger, G H Mumm & CIE and Veuve Cliquot. Prince Charles awarded the ninth Champagne royal warrant to Laurent Perrier in 2015.

Collectively these nine great Champagne marques have produced over 600 individual wines during the 68 year-reign of Queen Elizabeth II but only eleven vintage Champagnes have been awarded the perfect 100 point score by international critics. Of these Krug Clos de Mesnil 1996 is the most recent. Antonio Galloni, one of the leading fine wine critics, upgraded the vintage from 99 to 100 points in 2010 and at a subsequent tasting in 2019 rated it as “one of the greatest Champagnes I have ever tasted.”

Download Our Free Wine Investment Guide

As an investment – only the rarest and finest quality, vintage Champagnes are of interest to investors. Its general asset performance is stable long term growth with value increasing exponentially as the Champagne ages and becomes rarer. Transactions in Champagne on Liv-ex have increased markedly with volume up 75% since late 2016. Sparkling wines were also exempt from the US Trade Tariffs introduced in Autumn 2019 and this has further enhanced performance.

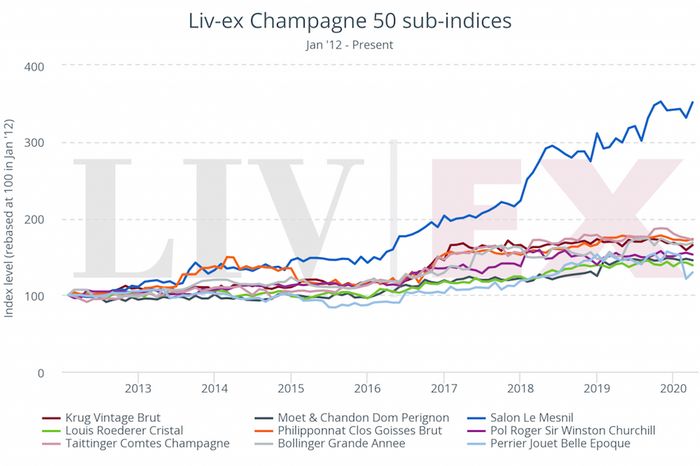

Liv-ex’s Champagne 50 index has risen by 42.5% over the last five years and 286% since the benchmark was introduced in 2003. The most active fine wine on the Liv-ex exchange in March 2020 was Dom Perignon 2008.

No doubt, Her Majesty will have enjoyed the perfect birthday toast as the wines of seven of the nine marques holding royal warrants also comprise the staple components of the Liv-ex Champagne 50 index and are producers of key investment wines.

For more information on investing in fine wine and creating a diversified portfolio including Champagne see our Guide to Fine Wine Investment and speak to a member of our team on 0203 384 2262.