The Wall Street Journal published an article on the 31st December stating that investors in luxury assets such as fine wine had been the market winners in 2018, seeing these investments outperform stocks and bonds. Liv-ex Director, Anthony Maxwell, commented to the author, Avantika Chilkoti, that there is an increasing demand for tangible assets as people look for havens for cash “outside securities and gold is not what it used to be”.

Geopolitical and economic challenges impacted US equities in the second half of 2018 and the FTSE has been struggling for some time. The S&P500 Total Returns ended the year down 5.1% and traditional safe havens did not meet expectations as gold futures showed a loss of 2.2per cent during the 12 months of 2018. In comparison, fine art had grown by more than 10 per cent at the end of November and fine wine closed the year with an average 10.2 per cent growth confirmed by Liv-ex.

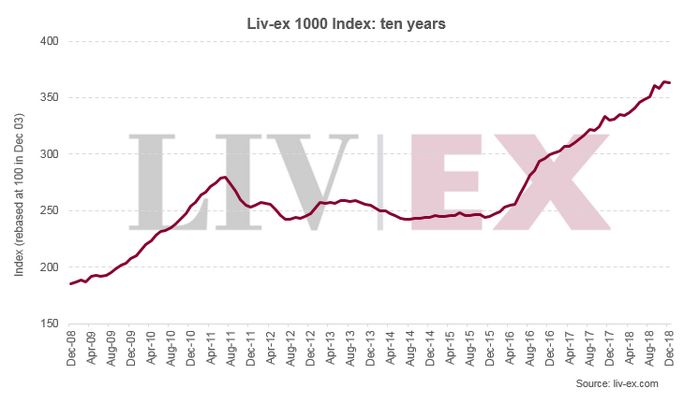

Source: Liv-ex .com

The Art Market Research’s Art 100 index records an average 10.6% gain in values to the 30th November 2018, but investors should be aware of the very illiquid secondary market and lack of transparency on valuations. Interest in fine art was certainly brought back into the limelight in Q4 2017 with the record-smashing auction sale of Leonardo da Vinci’s Salvator Mundi for $400million. In November 2018, a new record was set for the auction sale of a living artist’s work with David Hockney’s ‘Pool’ painting raising $90.3million at Christies in New York.

Knight Frank reported in its annual Wealth Report published in March last year, that classic cars had been the top performing luxury asset over the previous ten years, however 2018 proved a bumpy road for this market.

In comparison, fine wine showed an average growth of just over 10 percent over the last 12 months but some regional performances were considerably higher than that. Top Burgundies were the winners as illustrated by the Liv-ex Burgundy 150 index which rose 34.9 per cent. Individual record-breaking auction sales in the year saw two single bottles of Domaine de la Romanee Conti 1945 selling for £424,000 and £377,00 at auction.

Iconic wines from the US golden state also saw increased demand in 2018 and recognising the growing global status of the secondary market in these wines Liv-ex established the California 50 index mid-year and reported an annual gain of 21 per cent.

As the market in fine wine has broadened beyond the core Bordeaux focus (which still represents approximately 60 per cent of trade share on Liv-ex), investment-grade wines of Champagne, Rhone, Tuscany and California have enjoyed increasing demand and values. The Liv-ex Bordeaux Legends 50 index rose 8.3 per cent, the Champagne 50 increased by 7.8 per cent and the Rhone 100 saw an average gain of 7 per cent.

Currency has been an influencing factor, and in particular Brexit’s impact on political and economic certainty has weakened Sterling which has driven increased demand from international buyers as the UK still represents one of the world’s most important trading markets for fine wine.

The key message for investors at the start of 2019 is that the current uncertain environment isn’t going away any time soon and realistically equities will continue to be unpredictable. Diversifying a wine portfolio to include top performing wines from different regions is an important strategy to maximise returns from this rewarding asset. For more information download our Guide to Investing in Fine Wine, see our Tips on how to get started and call the Vin-X team on 0203 384 2262.