Chancellor Sunak’s spending review and plans for 2021 set out in the House of Commons yesterday made for a pretty sobering reality check with growing debt numbers as phenomenally large as the challenges we face. Notably, the skeleton in the Westminster cupboard on the 25th November was Brexit – seemingly not a significant driver in the Chancellor’s statement, but there is no doubt it’s a current cause of great uncertainty for UK and European businesses and for individuals considering how to protect capital and achieve growth in these very uncertain times.

What does Chancellor Sunak’s spending review mean for fine wine investors?

Chancellor Sunak’s spending review – impact for Liv-ex

So, what may investors in fine wine take from yesterday’s briefing from the green benches?

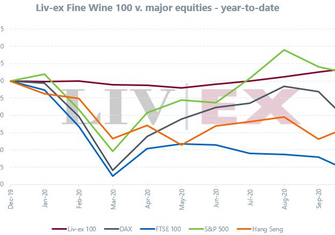

Whilst the light may well be gleaming at the end of the Covid Tunnel, in that we have a number of vaccines now looking to be rolled out, key sectors of the economy are going to continue to be depressed during 2021, and jobs and financial uncertainty will prevail for the foreseeable period. The gigantic growing shadow of a debt burden that will loom large over the coming years and decades ahead has most of us concerned. Financial markets can be expected to continue to remain volatile and investors must surely consider their options to hedge against volatility and extended recession / depression environments and achieve stability and growth where possible. Added to this is the Tax strategies that may be adopted and we have seen that Capital Gains Tax is in the Chancellor’s sights to address. Assets such as fine wine which are currently exempt may become even more attractive.

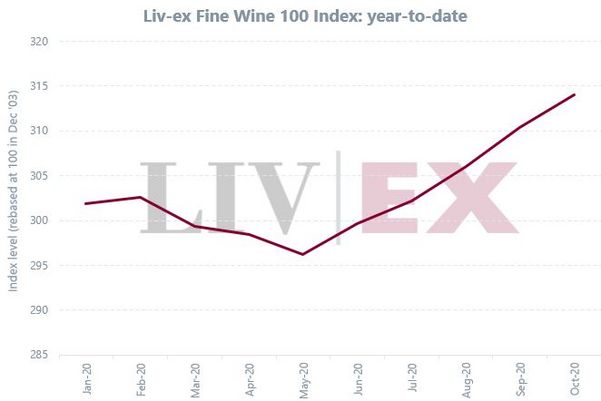

Despite this back-drop, fine wine market trends are still sustaining solid gains throughout 2020, delivering stronger returns than financial markets. We recently compared blue-chip equities with fine wine and specifically Rolls Royce versus USA’s iconic Screaming Eagle 2012. Liv-ex report this week that Screaming Eagle 2013 had risen to its highest price levels in November 2020, up 50% since it first began trading on the exchange in 2015 (4.5 years ago).

The top five wines in terms of market share by value mid-November traded on Liv-ex demonstrated regional demand and include iconic labels from Burgundy, USA and Bordeaux.

Top 5 wines Liv-ex market share by value 13 – 19 November 2020

| Region | Wine | Vintage | Price

(12 x 75cl) |

| Burgundy | DRC Romanée Conti, Grand Cru | 2017 | £152,000 |

| USA | Screaming Eagle, Oakville, Cabernet Sauvignon | 2013 | £24,960 |

| Italy | Soldera Casse Besse, Toscana 100% Sangiovese | 2015 | £4,364 |

| Bordeaux | Chateau Mouton Rothschild | 2010 | £5,706 |

| USA | Opus One, Napa Valley Overture | 2019 | £1,008 |

Source: Liv-ex.com 23.11.20

The importance of diversifying a fine wine portfolio with representation from key brands and vintages across a number of regions is evident from market data we regularly feature. We have commented frequently about including wines from Burgundy, Champagne, Italy and the USA alongside Bordeaux blue-chips to create a robust collection positioned for growth and able to deal with periods where there maybe drift on price. As with all investments demand and prices may rise and fall and ensuring a composition to manage risk is important in portfolio planning.

Bordeaux produces many of the most iconic wines in the world, but as the market has broadened, we have seen its share of trade on Liv-ex reduce. There is increasing demand for wines from other regions and increasing numbers of wines from these areas being traded on the exchange. Mid-November, Bordeaux’s trade share on Liv-ex stood at 40.5%, only the second time in ten weeks that it has been above 40%.

Burgundy’s ‘super-brand’ Domaine de la Romanée Conti led trade share by value mid-November due to transactions in DRC Romanée Conti 2017 at £125,000 (12 x 75cl). Despite economic challenges, there are still buyers for extremely high value wines. We saw this also demonstrated at the HDH fine wine auction in HK this month where more than US$3.1million was raised from the sale of key investment wines from Burgundy, Bordeaux and Champagne.

The top 5 wines by market share on Liv-ex last week also demonstrates the variety of entry points into the market for investors – from DRC 2017’s £125,000 case to Opus One 2019 at £1,008. Investors can shape a rewarding fine wine collection to their budget and their goals in terms of exit. Some fine enjoys a more active secondary market and this is a strong reason to include Bordeaux First Growths. These wines generally provide good liquidity due to the established nature of trade they enjoy with global demand.

Conclusion

Fine wine investors are currently enjoying stable growth from their investment wines and have done throughout 2020. With Chancellor Sunak’s spending review in mind there is a strong case for all investors to consider fine wine as an important tool for portfolio diversification in 2021.

For more information, please download our Guide to Collecting and Investing in Fine Wine and speak to an expert member of our team on 0203 384 2262.