Fine wine is topping up investors’ half-full glasses with rising values as wine investments are maintaining 2021’s positive growth into 2022, meanwhile assets such as property, are seeing their markets slow down in the face of rising interest rates and inflation.

Wine investment compared to property in January 2022:

| Asset | January 2022 | 1 year to 31.01.22 |

| UK Property price growth | 0.3% | 9.7% |

| Wine trend – Liv-ex 100 | 2% | 25.2% |

| Liv-ex Burgundy 150 | 6.4% | 36.76% |

| Liv-ex Champagne 50 | 5.6% | 47.7% |

Data source: Property price: Halifax, Wine: Liv-ex.com at 31st January 2022

What is driving wine investment growth in 2022?

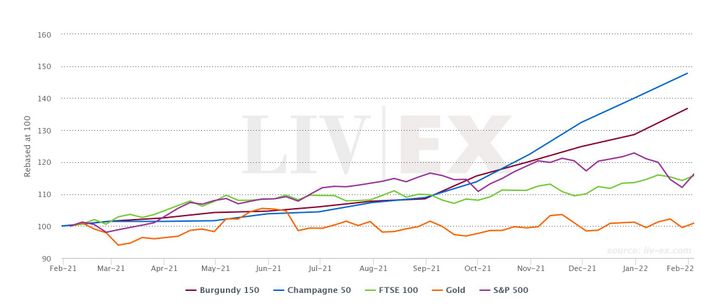

Key drivers of growth in wine investments are supply, demand, quality and performance. Fine wine assets delivered on all fronts last year with investment wines from Champagne and Burgundy giving outstanding returns. Champagne investment wines have enjoyed an average growth trend of nearly 50% and Burgundy 36.7% in the last 12 months, with no loss of momentum in the first month of the year.

January tends to be a ‘Burgundy month’ as a new vintage is released at this time each year. The region’s 2020’s release was snapped up as investors sought positions with lower supply available in both the 2019 wines last year and the anticipated 2021 vintage, which will be sold in 2023.

Burgundy top-performers grew up to 45% in January 2022

Burgundy investments saw average growth of 6.4% in January, but top performers provided much larger gains with Domaine Leflaive Bienvenues-Batard Montrchet 2018 rising 45% and Domaine Armand Rousseau Chambertin-Clos de Beze 2018 up 36%.

Champagne & Burgundy investments v. FTSE 100, Gold and S&P500 1 year

Champagne still the wine investment market darling

Champagne was the wine investment ‘toast’ of choice in 2021, when growth averaged 41% across the year. This trend has been carried into the new year, with the Liv-ex Champagne 50 rising 5.6% in January. Champagne investment wines were some of the most actively traded in the first month of 2022 with the release of Cristal 2014 adding new energy into a bubbly market. Louis Roederer’s flagship brand Cristal has investors frothing with the 2013 and 2008 vintages sparking the most demand in January. Cristal 2008’s 87% increase in price since its release shows the value of getting into the market of a wine early and the benefit of a longer-term hold. That said Cristal 2013 has seen its price rise 14.9% recently.

Find out more

The broader wine investment market, measured by the Liv-ex 1000 index, rose 3.5% in January, outperforming the FTSE100, property and other assets. Wine is more than demonstrating its value to investors. For more information on current opportunities contact us now on 0203 384 2262.