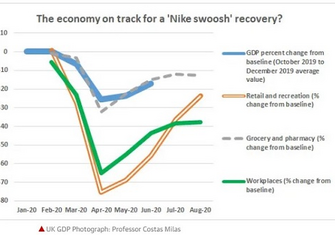

Will it be a ‘V’, a ‘U’, or more of a swoosh – like a ‘Nike tick’ – what form will the UK economic recovery take over the coming months or years? Currently the Holy Grail question. We are all digesting the recent ONS confirmation of the first UK recession for 11 years and the most important factor shaping young peoples’ lives with the chaotic management of the 2020 A-Level and GCSE results published in England and Wales. Announcements by key retail firms on redundancies and the lack of jobs for new school-leavers alongside the extra stress with university and other higher education places these are extremely worrying times for the next generation – the one that may pay the hardest price in terms of bearing the brunt of the swelling tax burden.

Governments have taken unprecedented steps to protect jobs where possible and provide support to companies and individuals, but consumer confidence has been battered by Coronavirus. Concern about job security going into the Autumn as the furlough scheme is wound down (although there is growing pressure for this to be reconsidered in vulnerable sectors) is creating a drag on economic recovery. Additional unpredictable influences include the US Presidential election in November and the fast-approaching Brexit, which entails a whole new level of uncertainty. Geo-political tensions are not going away, all of this has been further complicated by the pandemic and its highly likely re-emergence to a greater degree than the current localised spikes as we approach winter. It’s hard to think of a time more challenging and less certain for investors.

Our earlier blog reminded investors of the stable performance of fine wine as an investment asset, its track record of growth over the long term and its lack of correlation to financial markets making it an important tool for diversifying an investment portfolio. We looked at where lessons learned post the 2008 recession have been put into play in the current environment creating opportunities for investors and that now could be a once in a decade opportunity to create value and protect capital.

Liv-ex’s August Market Report to the fine wine trade has an opening statement that the number of unique wines traded on the exchange has reached an all-time high. Fine wine is continuing its upward trend in 2020. July data showed the first month of the year where both the Liv-ex 100 and broader measure, the Liv-ex 1000, saw positive gains. The Liv-ex 100 grew 1.5% in July, its highest level in five months and the Liv-ex 1000 component sub-indices are up– the RoW (Rest of World) led at 1.32%, Burgundy 150 up 1.31% and Champagne 50 – 1.19% month on month. Trade volume levels overall stayed near the record levels set in April, at the height of the Covid-impact on markets to date.

In terms of selecting the best fine wines for growth, in July the top five were dominated by iconic wines from Burgundy, Napa and Australia with USA’s Screaming Eagle 2012 leading the way, seeing a 10.1% uplift in the month from £27,600 (12 x 75cl) to £30,400. Penfolds also made its mark in July and we have recently commented on the latest 2016 release from the Antipodean super-star.

Top Fine Wine Performers on Liv-ex July 2020:

| Region | Wine | Vintage | June 2020 | July 2020 | Uplift |

| USA | Screaming Eagle | 2012 | £27,600 | £30,400 | 10.1% |

| Burgundy | Joseph Drouhin, Montrachet Marquis Laguiche | 2016 | £4,436 | £4,860 | 9.6% |

| Australia | Penfolds, Grange | 2014 | £3,595 | £3,861 | 7.4% |

| Burgundy | DRC, Echezaux | 2014 | £15,682 | £16,760 | 6.9% |

| Burgundy | Bonneau Martray, Corton Charlemagne | 2008 | £1,559 | £1770 | 9.1% |

Source: Liv-ex.com, August 2020

The prices involved in the top five traded wines in July illustrate the opportunity to enter the market at varying price points and still enjoy a good level of growth. Identifying the investment wines offering the best returns is key and timing is everything – sensitivity to the economic climate is an important factor to influencing returns and performance. Indeed – the shape of things to come!

Whether you are looking to start a fine wine collection or to add to your portfolio to protect capital over coming months, call our Fine Wine Experts on +44 (0) 203 384 2262 to find out which investment-grade wines are offering the best opportunities right now.